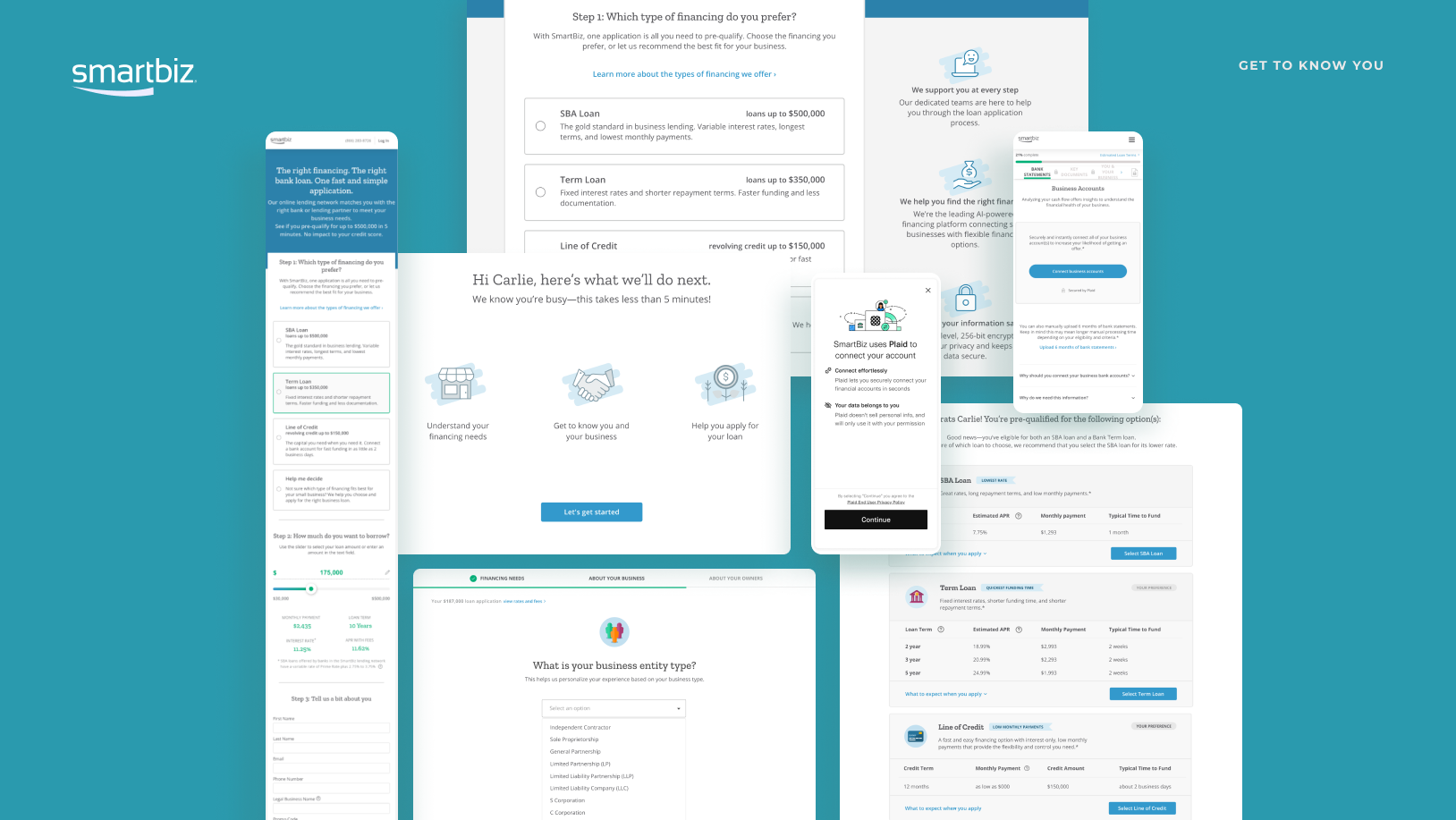

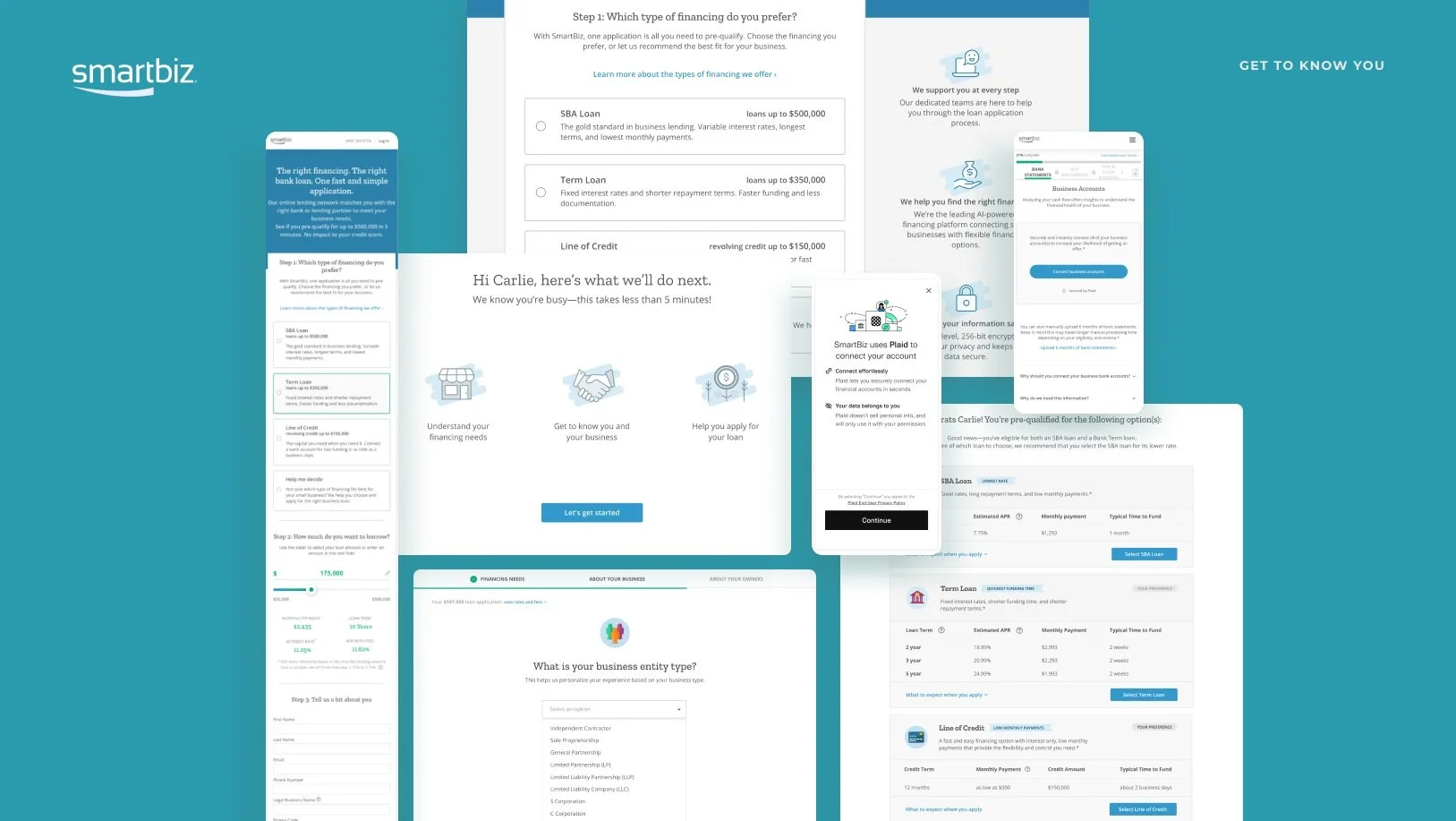

SmartBiz | Get To Know You

Reimagine the borrower experience

THE PROJECT

The current Smartbiz experience unintentionally anchors borrowers and does not gather key data early enough to effectively segment, prioritize and route borrower to the right funding options.

MY ROLE

I worked closely with Product and Engineering on discovery, research to understand painpoints and opportunity to build an experience from the borrower’s perspective.

SmartBiz is a lending marketplace that works small businesses, offering SBA loans, term loans, lines of credit and alternative financing through a network of bank partners and help increase approval rates by matching small businesses with the right funding option.

SmartBiz offers a prequalifying process that lets borrower know what / if they are eligible for a specific type of funding.

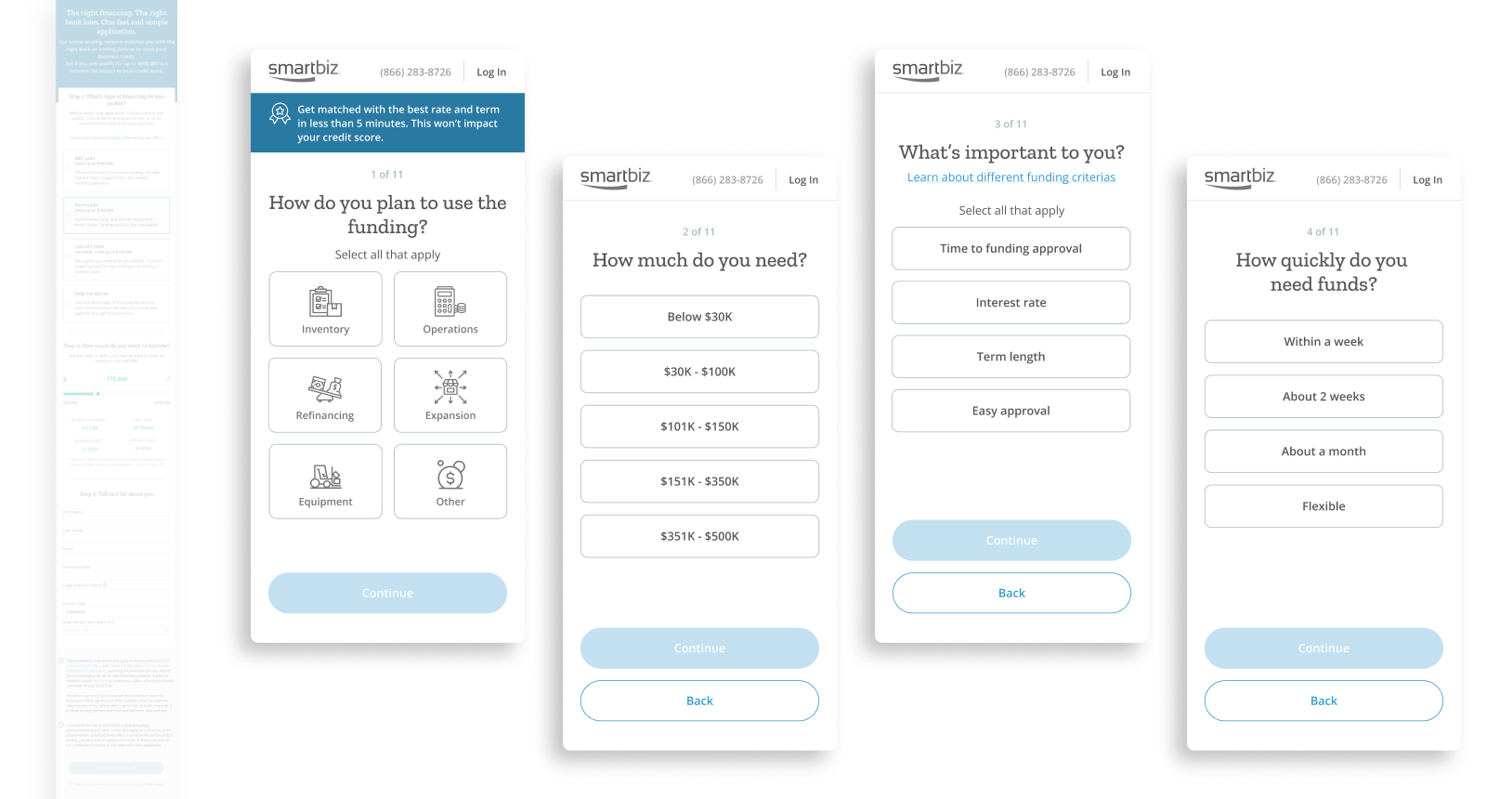

Considering the data, with over 50% of borrowers originating from mobile devices, the experience was suboptimal for small screens and lacked a user-centric approach.

In the discovery phase, it was essential to understand and uncover the primary business and user needs. Collaborating with stakeholders, engineering, and product teams, I pinpointed the initial problem statements as a foundation for further exploration.

I kicked things off to bring key teams into the conversation: funding operations, product manager, design, business analysts, and engineering. I ask them about their objectives, pain points, needs and expectations.

KEY LEARNINGS

Every stakeholder has their preferred sequence for gathering borrower information to expedite the prequalification step as quickly as possible. The discovery work helped identify a few common product and business goals & needs:

Minimize user confusion and streamlining the journey from the start to prequalification

Effective lead generation is crucial to capture potential borrowers at the top of the funnel, to support data acquistion for tracking and outreach.

The pre-qualification flow can help identify and prevent spam or fraud.

Painpoints and feedback were documented and shared with the team to foster iterative feedback loops and collaborative engagement. With this design-lead approach, I was able to align with stakeholders to prioritize and define the strategic roadmap as a team.

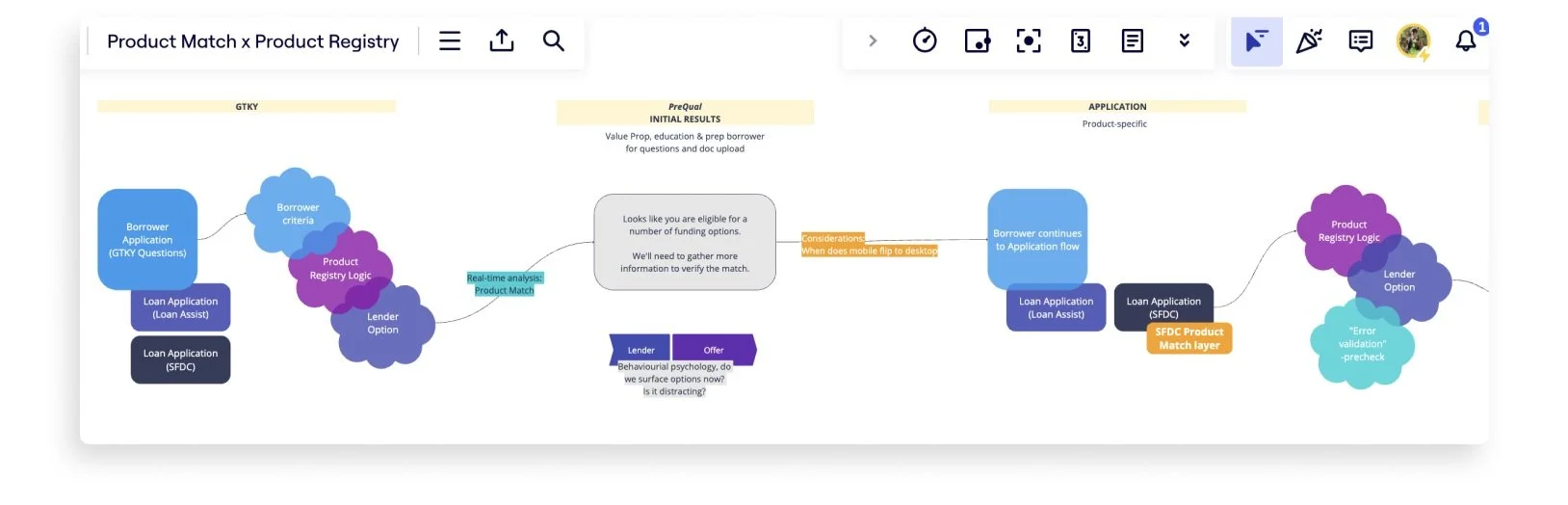

We worked in parallel with the systems architecture and service platform teams to ensure a holistic view on the front and backend redesign of the user experience. The borrower experience heavily impacts data consumption and information account managers can see in Salesforce.

The redesign offered opportunity to restructure the backend to scale the business and increase flexibility.

In the design exploration phase, I continue to communicate how my solutions strategically address business goals, user needs and technical constraints. Product, enginnering and stakeholders were invited to collaborate and ensure buy-in throughout the process.

One primary problem is “Product Match” — what is the quickest way to check borrower eligibility in order to determine the right funding product they are qualified for? We used “How Might We” (HMW) statements to ideate on the right problems while keeping teams focused on the right problems to solve.

As a business, how might we understand, as early as possible, a borrower’s likelihood to qualify and ability to repay the loan?

As a user, how might I choose the right product, and ask for amount I can be eligible for?

Sharing these HMW statements with stakeholders helped set the team up for success in framing the design challenge.

With over 50% of borrowers originating from mobile devices, the goal was to break content down into digestible form to improve the user experience.

Design decisions on the interactions, pacing, design and content are supported by user research insights with tools like usertesting.com.

Starting with a well-defined foundation, supported by user research insights and UX benchmarks, I tackled the challenge by building trust and crafting a tailored set of initial questions to effectively capture essential data at the top of the funnel for lead generation.

The result was reduced speed from start to account creation and prequalify: 27% Increase in customer acquisition, and 67% Reduction in time to loan prequalification.

The project introduced a new internal partnership process, guaranteeing active engagement and alignment of stakeholders throughout the product design journey.